About Offshore Company Formation

Table of ContentsOffshore Company Formation for BeginnersA Biased View of Offshore Company FormationOffshore Company Formation Can Be Fun For EveryoneOffshore Company Formation Can Be Fun For EveryoneGet This Report on Offshore Company FormationSee This Report on Offshore Company Formation

There are frequently less legal commitments of managers of an offshore company. It is additionally usually easy to establish up an overseas company and also the process is easier contrasted to having an onshore business in lots of parts of the globe.If you are a businessman, for instance, you can develop an offshore business for discretion purposes and also for convenience of management. An offshore business can also be utilized to bring out a working as a consultant business.

Offshore Company Formation Things To Know Before You Buy

The process can take as little as 15 mins. Even before forming an overseas firm, it is first important to recognize why you favor offshore business development to establishing up an onshore firm.

If your main objective for opening up an overseas business is for personal privacy functions, you can hide your names utilizing nominee solutions. With candidate services, an additional person occupies your function as well as indicators documents on your behalf. This indicates that your identification will continue to be personal. There are numerous points that you should remember when selecting an overseas territory.

Not known Details About Offshore Company Formation

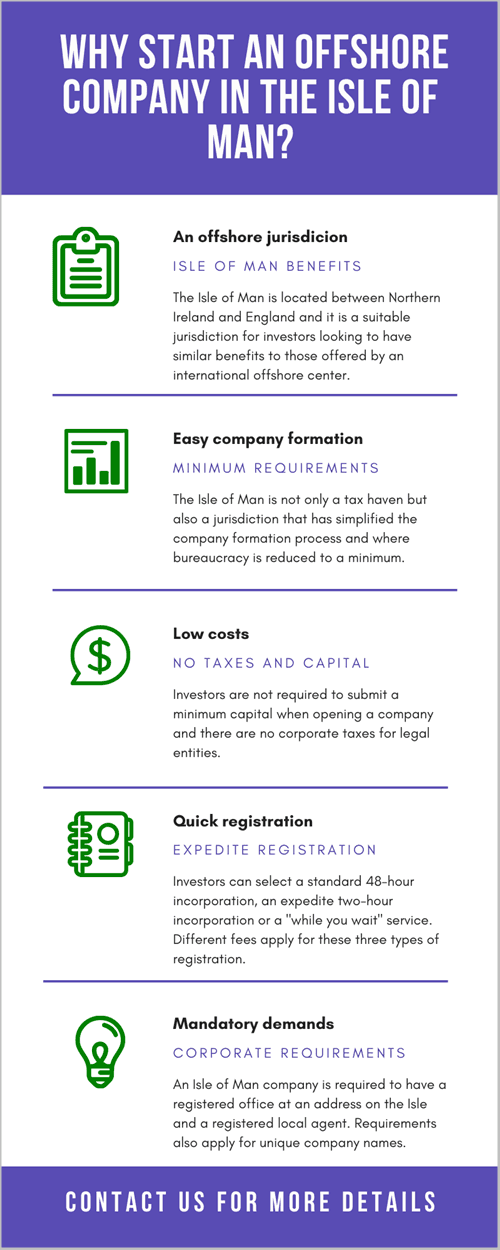

There are fairly a number of overseas territories and also the entire job of coming up with the ideal one can be fairly complicated. There are a variety of things that you likewise need to take into consideration when choosing an overseas jurisdiction. Each area has its very own distinct benefits. A few of the important things that you have to think about include your residency circumstance, your company and also your financial requirements.

If you established an overseas firm in Hong Kong, you can trade globally without paying any type of regional taxes; the only problem is that you should not have an income from Hong Kong. There are no taxes on funding gains as well as financial investment earnings. The place is also politically and also economically steady. offshore look at here company formation.

With so numerous jurisdictions to pick from, you can constantly discover the ideal place to develop your offshore firm. It is, however, crucial to pay focus to information when creating your option as not all business will certainly enable you to open for checking account as well as you require to guarantee you practice correct tax preparation for your regional as well as the international territory.

Some Known Factual Statements About Offshore Company Formation

Corporate structuring as well as preparation have achieved higher degrees of intricacy than ever while the requirement for privacy remains solid. Firms should maintain rate as well as be frequently in search of brand-new means to benefit. One way is to have a clear understanding of the attributes of overseas foreign firms, and also how they may be put to beneficial usage.

A more correct term to make use of would certainly be tax obligation mitigation or planning, because there are means of mitigating tax obligations without breaking the regulation, whereas tax evasion is usually identified as a crime. Yes, because many nations encourage global profession as well as enterprise, so there are usually no restrictions on residents doing business or having checking account in various other countries.

All about Offshore Company Formation

Advanced and credible high-net-worth individuals and also companies consistently utilize offshore financial investment cars worldwide. Protecting properties in combination with a Trust fund, an offshore firm can prevent high levels of revenue, capital and also fatality taxes that would certainly otherwise be payable if the possessions were held straight. It can also secure properties from financial institutions and various other interested events.

If the firm shares are held by Our site a Depend on, the possession is legitimately vested in the trustee, thus obtaining the capacity for also higher tax obligation planning benefits. Household and also Protective Depends on (perhaps as an option to a Will) for buildup of investment revenue and lasting benefits for recipients on a positive tax obligation basis (without earnings, inheritance or capital gains taxes); The sale or probate of buildings in various countries can end up being intricate and pricey.

Conduct business without business tax obligations - offshore company formation. Tax sanctuaries, such as British Virgin Islands, allow the formation of International Business that have no tax obligation or reporting obligations. This means you save cash not just from the lack of corporate tax obligations, but additionally from other regulative expenses. Allow work or consultancy fees to gather in a reduced tax obligation area.

Offshore Company Formation - Truths

This enables the costs to gather in a reduced tax obligation jurisdiction. International Companies have the very same legal rights as a private person and can make investments, acquire and offer realty, trade portfolios of supplies and also bonds, and carry out any lawful organization tasks as long as these are not done in the nation of registration.